As of September 2017, Tinder was the highest-grossing app on the app store among US consumers.

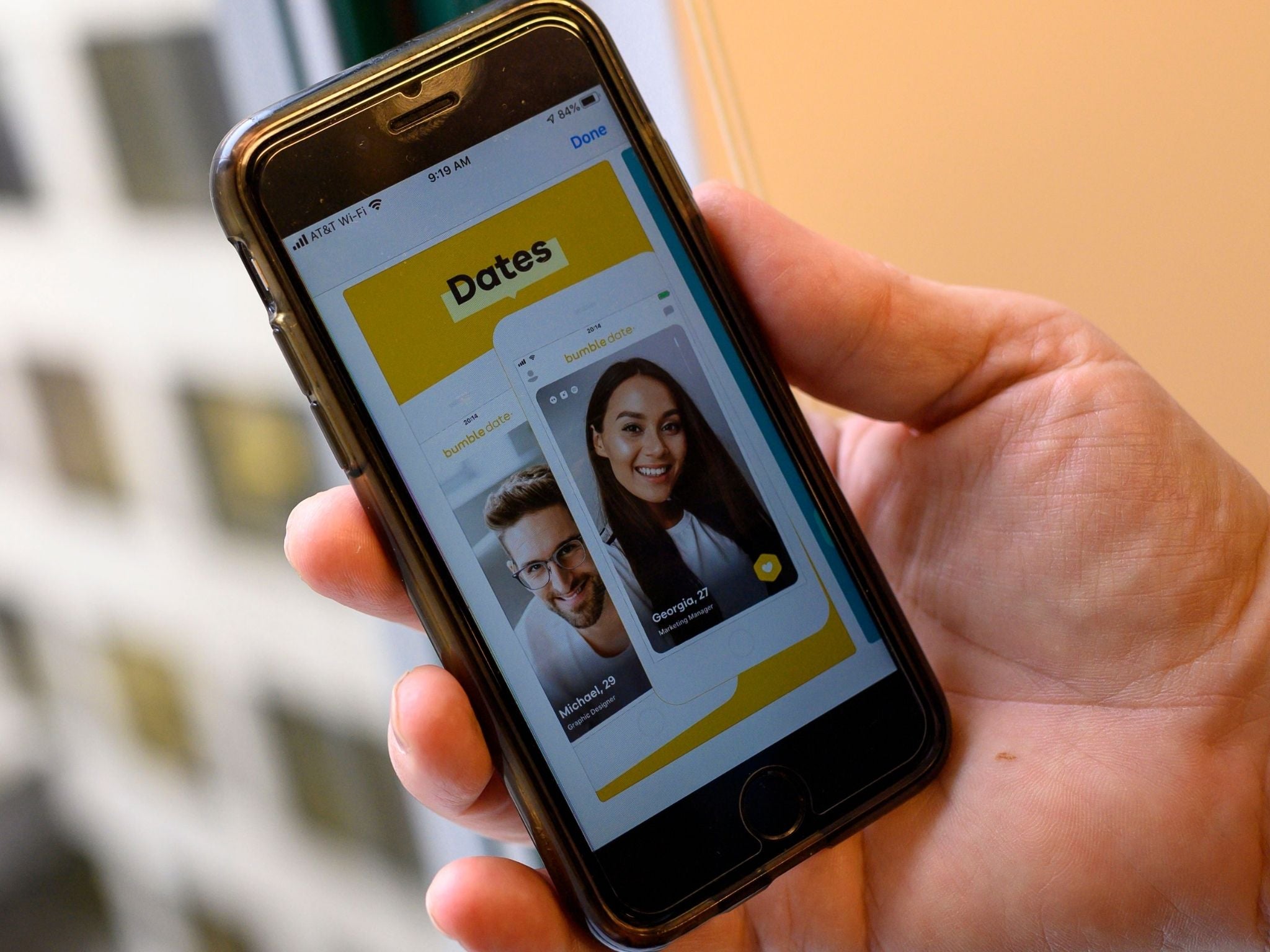

Freemium - Upgraded Features: Though basic membership is free, users can pay for extra, enhanced features.Certain apps and the "swipe left or right" mechanism seems particularly suited for native advertising, ads that match the look and feel of the media format that they appear in. Freemium - Advertising: In-app advertising is a way for the app to generate shared revenue with advertisers from clicks, views or transactions.Without a barrier to entry, freemium dating apps often wait to build scale, loyalty, and active users until they introduce paid features. Freemium: The freemium model allows for users to sign up and use the basic functionalities of the app for free, while the app generates revenue either via advertising or unlocking enhanced features for a fee.Typically, the paid subscriptions are cheaper by the month if the user commits to a longer period of time. Zoosk, eHarmony, and Chemistry, and Our Time are also paid dating services. Membership subscriptions: The subscription model is the oldest model in the dating app sphere, requiring users to pay a fee to use the app for a set period of time.The Online Dating Industry Business Model Match Group actually comprises 45 brands, including big names such as, OkCupid, and Tinder. The second largest competitor is eHarmony, with just under 12%. The biggest player in the online dating game, the Match Group, dominates 25% of the market share.However, when it comes to user engagement, Grindr (12 hours 26 minutes/month), Tinder (2 hours 39 minutes/month), OkCupid, and Bumble are at the top. When it comes to the most popular apps in the US by audience size, Tinder, Plenty of Fish, and OkCupid lead the pack (respectively).The League is an elite dating app focused on accomplished, ambitious young professionals. Bumble uses a similar format to Tinder, but with a twist: only women can send the first message. Tinder pairs potential hookups based on a mere glance and swipe of a photograph, is easy to use, and is user-friendly. Each app has its own competitive advantage or spin on the dating game: With its monthly subscription fee, attracts people willing to put their money where their mouth is.Net loss widened to $26.1 million during the quarter, or 1 cent a share, from a net loss of $17.2 million a year ago.The Online Dating Industry's Major Players Analysts on average had expected a revenue of $163.3 million, according to Refinitiv IBES data.

ACTIVE USERS BUMBLE PROFESSIONAL

It also has verticals like Bumble BFF and Bumble Bizz that are dedicated to make friendships and professional connection.įounded by Tinder co-founder Whitney Wolfe Herd, Bumble raised $2.2 billion in its initial public offering last month, following which Herd became the youngest female CEO to ever take a company public.īumble, which operates two major apps Badoo and Bumble, posted a 31.1% rise in revenue to $165.6 million in the fourth quarter, first earnings report since it went public. The company differentiates itself from competitors, biggest rival being Match Group's Tinder, by allowing women to make the first move. dating market, with close to 5.5 million average monthly active users and 2.2 million downloads in the United States alone, during the quarter, according to data from analytics firm Apptopia. Texas-based Bumble expects current quarter revenue to be in the range of $163 million and $165 million.īumble boasted of 12.7% of the U.S. The company said it will build its friendship product Bumble BFF beyond its minimum viable offering as it expects friendships and platonic relationships at large to be a massive opportunity going forward. Bumble Inc on Wednesday said it expects pent up demand from people who had been avoiding dating in person due to the COVID-19 pandemic, after it reported a bigger-than-expected rise in fourth-quarter revenue.ĭating apps have benefited from social distancing restrictions that made people yearn for company as casual gatherings with friends and family became a rarity.

0 kommentar(er)

0 kommentar(er)